Oil prices have plunged again.

After meandering lower for the last two weeks, the Brent price has suddenly dropped about 7 US cents in a couple of days, West Texas about the same.

Surely our petrol prices will be lowered again? Is the Commerce Commission watching? Perhaps the AA?

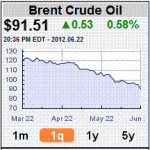

Over three months, there’s been a very consistent drop. The Saudis will be pleased at the controlled plunge, happy they’ve avoided panic selling and hoping for higher prices in the long run.

Unfortunately it means the Western economies are still in the doldrums. Maybe China can save us?

Anybody been following the reasons behind the oil price slump?

Views: 46

“Anybody been following the reasons behind the oil price slump?”

Oil Price History and Analysis

http://www.wtrg.com/prices.htm

My experience. By the end of 1998, the nominal price was down to $10 after plummeting from pre Kyoto Protocol $18. I took a financial hammering because I was trying to make a living trading oil exploration options at the time among other things. The KP was the straw that broke (my) camel’s back and many oil explorers on the Australian board ceased operations. I stayed in far too long because I wasn’t reading the big picture signs whilst immersed in drilling reports etc. Plus the internet wasn’t as pervasive as it is now so putting the picture together was not nearly as easy for me as it is now.

http://www.wtrg.com/oil_graphs/small/crudeoilprice9703.gif

Being of optimistic nature, I found it difficult to conceive that the price would drop by 2/3 from $30 to $10 in the space of 2 years but it did. Similarly right now, people will find it difficult to conceive that oil prices could collapse in that fashion but there is no reason why not.

Gold on the other hand will probably have good support because people are returning to a de facto gold standard now that fiat currencies are tottering. I’m still kicking myself for not buying in at $250 in the early 00s when the chance was staring me in the face but I couldn’t see it at the time (distractions) http://goldprice.org/gold-price-history.html

Quoting the oil article (from a couple of years back):-

That is, the oil price is telling the real story – the global economy is in recession.

Petrol prices at the pump on the other hand are constrained by refining capacity and rather than more being constructed, the opposite is happening from what I can gather (but I’m not really keeping up at all); refineries are being closed.

Hi Richard C.And any other.I have been looking at the study of the earth population,which some say is too high.Delving a little further,I believe the total mass of humans is 287 million tonnes.Obesity gives an increase of 15 million tonnes.I am only 60kg’s,so al gore would make perhaps nearly 3 of me.I have only looked at this tonight,so have to say my figures may be wrong,I need you experts to tell me if we tackled obesity, would it in fact lead to the betterment of our world?I know I’m off topic,but just wondered how many people the planet could sustain if we were all an average weight?Just thinking.My mind boggles.

“….if we tackled obesity, would it in fact lead to the betterment of our world?”

Probably not if you’re a fast food franchisee or part of the supply chain. Layoffs, redundancies, riots, chaos. Factories left idle, crops growing wild, animals gone feral, it just wouldn’t work – too many unintended consequences.

Besides, obesity drives the global economy. As the song goes:-

“Fat bottomed girls, you make the rockin’ world go round”

Citation http://www.elyrics.net/read/q/queen-lyrics/fat-bottomed-girls-lyrics.html

LOL.Yeah,fair enough.I do like fat bottomed girls.Or for that matter,slim bottomed girls.In fact,any bottomed girls.LOL.I see Rio+20 finished in failure,or as Marc Morano said,that was a success for the poor people of the world.Just spent a few days in Hamilton.There was a couple of really good frosts,but stopped my system from freezing by adding alcohol to my system.Mt Egmont was a picture a few days ago.The sun reflecting off the snow was amazing.So cold at night here I bought a sheepskin coat for my dog.Have a good night,see you soon,cheers,Billy

I, too, am in the oil business. The company I was with in Jan ’98 went insolvent and bankrupt when oil prices in December at $26/bbl went to $10/barrel in January. Right now the one I’m with is selling off assets to pay down debt created during the +$100 days, as the current prices don’t produce enough cash flow to handle costs plus new investments. One wonders why this is before one wonders why there is a further price drop?

The US and other nations have not recovered from the 2008 or earlier slump. In fact the economies are worse: when you hear of a 0.1% rise in GDP in inflationary times (even small ones) that means that the economies are shrinking. Our economies are tied to energy use as understood by all who argue for cheap energy. On the reverse side, our energy use is tied to our economy by all who try to make a living in it.

The demand for oil and gas is less than the current supply situation, regardless of the cost of the product. Gas storage is at an all time high, while less-conventional oil sources are growing stronger every day. That means there is too much oil and gas around for demand, which pushes prices down. Unfortunately this is occurring at a time of an all-time high of extraction costs: the truth that the shale-gas and horizontal drilling advocates constantly miss.

We can’t make any money at $80/bbl because the projects cost $60/bbl and there isn’t enough oil (or gas) per project to pay for the project out of the remaining $20/bbl. It isn’t that the oil sands, the oil shales, the gas shales don’t have a lot of reserves in them. It is that the cost of getting these new sources to produce are huge relative to what you get.

In a sane world we would use the cheap energy sources and leave for later the more expensive ones. Of course, that is why the oil sands etc. are with us today: they were recognized to exist a long time ago, but the cost per btu was greater than the competing, price-setting btu from elsewhere. Now we are supposed to have our salvation in the high-price parts – while a demand slump has made the conventional sources adequate for our needs. Unfortunately these high price parts can’t be turned on and off at will. Or without bankrupting the companies invovled, anyway. So the production continues, and the supply glut stays.

In Canada, and I suspect elsewhere, oil and gas companies are starting to fold with the low prices in a high cost environment, especially if you include the onerous debt servicing that drove them into the stratosphere the last 12 years. This will shrink both output and administrative costs, but will do little to tackle extraction costs. Consumers eventually will feel the pain as the costs of the energy they use reflects the high cost types. If coal is hammered in the world (excluding China, of course) then coal’s energy production will be replaced by the expensive oil and gas, which will bring down the glut. Somehow I doubt that this will happen, however, as low energy costs are the foundation on which all pleasant life is based.

This rambled (it is Saturday morning here,and I am tired from Friday night). To get back on point: prices are falling because there is an oil and gas glut due to a slumped and slumping economy that doesn’t need as much energy as is available. The price drop reflects desperation selling, however, not extraction costs, and also the impracticality of shutting down new source wells and mines due to essential debt financing and survival cash flow needs. Prices will rise, however, if coal mines and power plants are shut down and insolvency and bankruptcy of exploration and production companies force exploration to stop bringing on new but unprofitable reserves – but only when storage is being drained regularly.

Finally, when demand exceeds supply of conventional sources, the tar sands etc. will come in to fill the void, but at prices that reflect the new, higher extraction costs, not just the conventional costs plus profits.

The future is clear but expensive.